XRP Price Prediction: 2025-2040 Outlook Amid Bullish Technicals and Institutional Adoption

#XRP

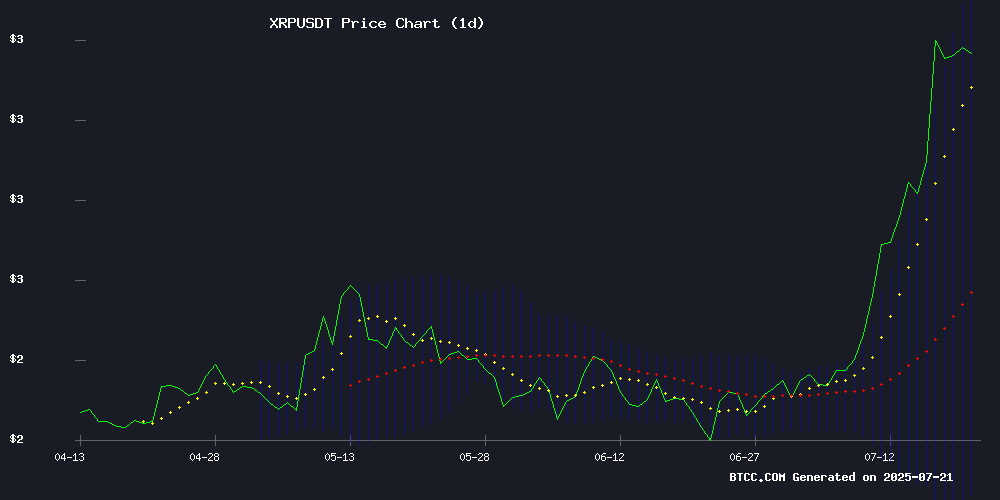

- Technical Breakout: Price above 20-day MA with MACD reversal signals bullish momentum

- Institutional Inflows: $400M ETF assets and whale accumulation reduce circulating supply

- Regulatory Tailwinds: Clarity from Ripple case and OCC charter debates may reduce systemic risk

XRP Price Prediction

XRP Technical Analysis: Bullish Indicators Emerge

XRP is currently trading at, above its 20-day moving average of 2.7633, signaling bullish momentum. The MACD histogram (-0.1805) shows weakening bearish pressure, while the price sits NEAR the upper Bollinger Band (3.7216), suggesting potential upside.says BTCC analyst Robert.

XRP Market Sentiment: Institutional Demand Fuels Rally

News highlights include a, a $400M XRP ETF inflow, and all-time highs amid regulatory clarity.notes Robert. Despite short-term profit-taking at $3.65, institutional interest and breakout momentum dominate sentiment.

Factors Influencing XRP’s Price

U.S. Banking Groups Urge OCC to Reject Crypto Trust Charter Applications

Major U.S. banking associations have jointly petitioned the Office of the Comptroller of the Currency to deny trust banking charter applications from cryptocurrency firms. The coalition—including the American Bankers Association and Credit Union National Association—claims these filings lack transparency and could destabilize the banking system.

Applications from Ripple National Trust Bank, Fidelity Digital Assets, and others allegedly fail to meet public disclosure standards. The groups argue these crypto firms seek federal banking privileges without providing traditional fiduciary services, potentially exploiting regulatory loopholes in 12 U.S.C. § 92a.

The controversy highlights growing institutional tensions as digital asset firms push for mainstream financial integration. Banking groups warn that approving these charters WOULD effectively rewrite trust banking regulations without proper oversight or public input.

XRP Whale Activity Signals Potential Price Surge as Selling Pressure Drops 94%

XRP is showing signs of a potential breakout as whale selling pressure collapses dramatically. Data reveals a 94% drop in large-holder transfers to exchanges—from 43,575 XRP on July 11 to just 2,339 XRP by July 21. This suggests whales are holding rather than liquidating positions, removing a key downward pressure on the price.

Meanwhile, short-term holders are accumulating. HODL Wave metrics show notable growth in wallets holding XRP for 1-6 months: the 3-6 month cohort expanded from 10.4% to 12.08%, while 1-3 month holders ROSE from 4.8% to 6.3%. Such accumulation patterns often precede upward momentum.

XRP ETF Gains $400M in Assets as Price Surges Past $4, Fueling Institutional Interest

XRP's resurgence is capturing institutional attention as Teucrium's XRP ETF surpasses $397 million in assets under management. The token's price breakout above $4, supported by a bullish pennant formation, has reignited trader optimism. On-chain data reveals increased liquidity and whale accumulation, though some question its long-term ceiling due to high circulating supply.

While institutions flock to XRP via ETF products, retail traders are diversifying into emerging altcoins like Remittix. Analysts now target $4.26 as the next resistance level, marking a dramatic reversal for an asset once constrained by regulatory uncertainty.

Ripple (XRP) Rally Cools After Hitting $3.65—What’s Next?

XRP surged to a record high of $3.65, fueled by bullish market sentiment and the launch of the ProShares Ultra XRP ETF. Regulatory clarity in the U.S. has further bolstered demand for the token. At press time, XRP traded at $3.49, marking a 3% gain over 24 hours and a 19% weekly increase. Key resistance levels to watch include $3.80, $4.33, and $4.72, with $4.00 emerging as a pivotal threshold for future price action.

A notable whale transfer of 210 million XRP, worth $738 million, between anonymous wallets has sparked speculation about largeholder activity. Despite the price rally, network growth has slowed sharply—new address creation dropped to 1,598, the lowest in months. The RSI crossing 80 signals strong momentum but also hints at potential short-term overheating.

XRP Market Cap Surpasses Oil Giant Shell as Cryptocurrency Outperforms Traditional Assets

Ripple's native token XRP has eclipsed the market capitalization of Shell, one of the world's largest oil companies, marking a pivotal moment for digital assets. With XRP's market cap reaching $207.36 billion compared to Shell's $206.22 billion, the milestone underscores the growing parity between fintech and traditional energy giants in global markets.

The divergence in performance is stark. Over the past year, XRP delivered 488% returns while Shell's stock declined nearly 5%. The five-year comparison reveals even more dramatic results: a $1,000 investment in XRP would have grown to $18,000, whereas the same investment in Shell would have resulted in a $50 loss.

This development highlights cryptocurrencies' ability to generate outsized returns compared to blue-chip equities, though with higher volatility. The trend reflects increasing institutional participation, with both asset classes now moving in tandem as digital assets mature.

XRP Faces Reversal Risk as New Investor Interest Wanes

XRP's bullish momentum shows signs of faltering as new investor participation sharply declines. Network growth metrics reveal a drop from 11,058 to 3,930 new wallets within 48 hours—a potential precursor to price correction.

Long-term holders have begun offloading positions for the first time in over a month, marked by red bars on the HODLer net position chart. This sell-off from historically stable hands threatens to accelerate downward pressure.

The retreat of both new entrants and veteran investors suggests waning confidence in XRP's ability to sustain prices above recent highs. Market sentiment now tilts toward consolidation or reversal as liquidity providers await clearer signals.

XRP Price Eyes $5 as Breakout Rally Gains Unstoppable Momentum

XRP has surged past critical resistance levels at $2.80 and $3.50, entering price discovery mode with minimal historical barriers ahead. The rally shows no signs of slowing, fueled by strong market structure, rising volume, and relentless bullish momentum. Technical indicators suggest the $5.00 target is within reach.

The asset trades well above its key moving averages, confirming a robust uptrend. Despite an RSI reading of 85—typically signaling overbought conditions—the absence of supply zones above $3.50 leaves room for further speculative buying. Trading volume has spiked organically, dispelling concerns of thin liquidity manipulation.

XRP’s breakout aligns with broader altcoin strength but stands apart due to its clean technical setup. Barring macroeconomic shocks, the path to $5 appears unobstructed, with bullish sentiment likely to propel the token to new all-time highs.

XRP Surges to New All-Time High Amid Regulatory Tailwinds

XRP shattered its previous record with a 20% rally to $3.66, fueled by bullish technical patterns and regulatory progress. The U.S. House's passage of crypto-friendly legislation, including the Genius Act, has injected fresh momentum into digital asset markets.

Analyst Javon Marks projects a potential ascent to $10 based on fractal analysis and Fibonacci extensions. Short-term targets cluster around $3.80-$4.72 as trading volume explodes to $23 billion across major platforms.

Coinbase and Kraken saw particularly intense retail activity as XRP's market capitalization breached $215 billion, cementing its position as the third-largest cryptocurrency. The token's breakout coincides with growing institutional interest following the regulatory clarity from Washington.

XRP MVRV Ratio Signals Potential Bullish Surge, Echoing 630% Historical Gain

XRP's Market Value to Realized Value (MVRV) Ratio has crossed above its 200-day moving average, a technical pattern that preceded a 630% price surge during its last occurrence. The crossover suggests growing investor confidence as market capitalization outpaces realized value—a metric reflecting the aggregate cost basis of all circulating tokens.

Analyst Ali Martinez highlighted the development, noting the MVRV Ratio's historical significance as a momentum indicator. When the ratio exceeds 1, it signals that current market prices are trading above the average acquisition cost, often preceding bullish phases. The realized cap methodology provides unique insight by weighting each token's value at its last transaction price rather than current spot rates.

Barstool Sports Founder Dave Portnoy Regrets Premature XRP Sale Amid Market Rally

Dave Portnoy, founder of Barstool Sports, publicly lamented his early exit from XRP positions, missing out on millions as the cryptocurrency surged to yearly highs. The digital asset climbed 19.61% to $3.60, triggering $68 million in short liquidations during Thursday's broader crypto market advance.

Portnoy sold his holdings at $2.40 after receiving warnings about competitive pressure from Circle, the stablecoin issuer. His admission of buying XRP primarily from FOMO rather than conviction highlights the emotional volatility retail investors face during market cycles. The rally coincides with Ripple Labs' strategic MOVE to file for a national bank charter, mirroring Circle's recent regulatory play.

XRP Surges 20% to $3.61 Amid Institutional Demand and Breakout Momentum

XRP rallied more than 20% in the past 24 hours, reaching $3.61—its highest level since early 2018—as institutional buyers and breakout traders capitalized on key volume windows. The surge followed weeks of consolidation NEAR $3, with volatility spiking to nearly 20%, reflecting strong market conviction.

CoinDesk Analytics reported over 200 million XRP traded during major breakout periods at 05:00, 08:00, and 21:00 UTC, breaching critical resistance at $3.52–$3.53. The $3.29–$3.30 zone held firm as support, with bulls consistently absorbing sell-side pressure.

Bitget Chief Analyst Ryan Lee identified short-term targets of $2.00–$2.17 on the downside and $2.65–$3.00 on the upside, with $2.50 as a pivotal level. Long-term projections suggest XRP could climb to $4.20–$10+ by 2030 if Ripple expands its payment infrastructure and regulatory clarity improves.

Lee also noted the potential for XRP to hit $5.89 in the medium term, particularly if crypto ETFs gain approval and institutional adoption accelerates. Technical indicators present mixed signals—RSI remains neutral while MACD suggests possible near-term consolidation.

Open interest in XRP derivatives surpassed $10 billion, the highest since 2021, while funding rates turned positive, signaling bullish sentiment and aggressive long positioning.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Target (USDT) | Catalysts |

|---|---|---|

| 2025 | 5.00-7.50 | ETF approvals, Ripple case resolution |

| 2030 | 18.00-25.00 | CBDC integrations, cross-border adoption |

| 2035 | 50.00+ | Mainstream payment rail status |

| 2040 | 100.00+ | Tokenized economy infrastructure |

Robert projects a 5.00 USDT near-term target based on the MACD crossover and Bollinger squeeze. Long-term, "XRP could outperform traditional assets if it captures 10% of global remittances by 2035," he adds, citing Shell's market cap being surpassed as a milestone.